In a financial world that’s becoming increasingly complex, Albert emerges not just as an app but as a companion in your pocket—a digital financial assistant that understands your money needs are as unique as you are.

Simplify Your Money Management

Albert doesn’t just watch from the sidelines; it actively helps you save by analyzing your income, spending habits, and financial patterns. It’s like having a vigilant friend who taps you on the shoulder when you’re about to overspend on that latte and says, “Hey, let’s put that towards your vacation fund instead.”

Cash Advances, Minus the Anxiety

We’ve all been there—facing an unexpected expense before payday. Albert swoops in to save the day with cash advances up to $250. It’s like having an understanding relative who can lend you cash without the awkward Thanksgiving dinner conversations.

Investing Made Intuitive

For the investment-curious who have felt overwhelmed by jargon and graphs, Albert demystifies the process. Want to invest in companies that are changing the world, or looking for a conservative portfolio to nest your future dreams? Albert has you covered, and you can start with as little as $1.

Unlock the Genius Within

With the Genius subscription, you unlock a circle of financial gurus ready to offer personalized money advice. Think of it as your financial think tank, without the hefty consultant fees.

The Smart Savings Advantage

Albert’s Smart Savings feature discreetly sets aside small amounts of money, so your savings grow almost without you noticing. It’s the virtual equivalent of finding forgotten money in your winter coat, but way more frequent.

Your Spending, Categorized and Simplified

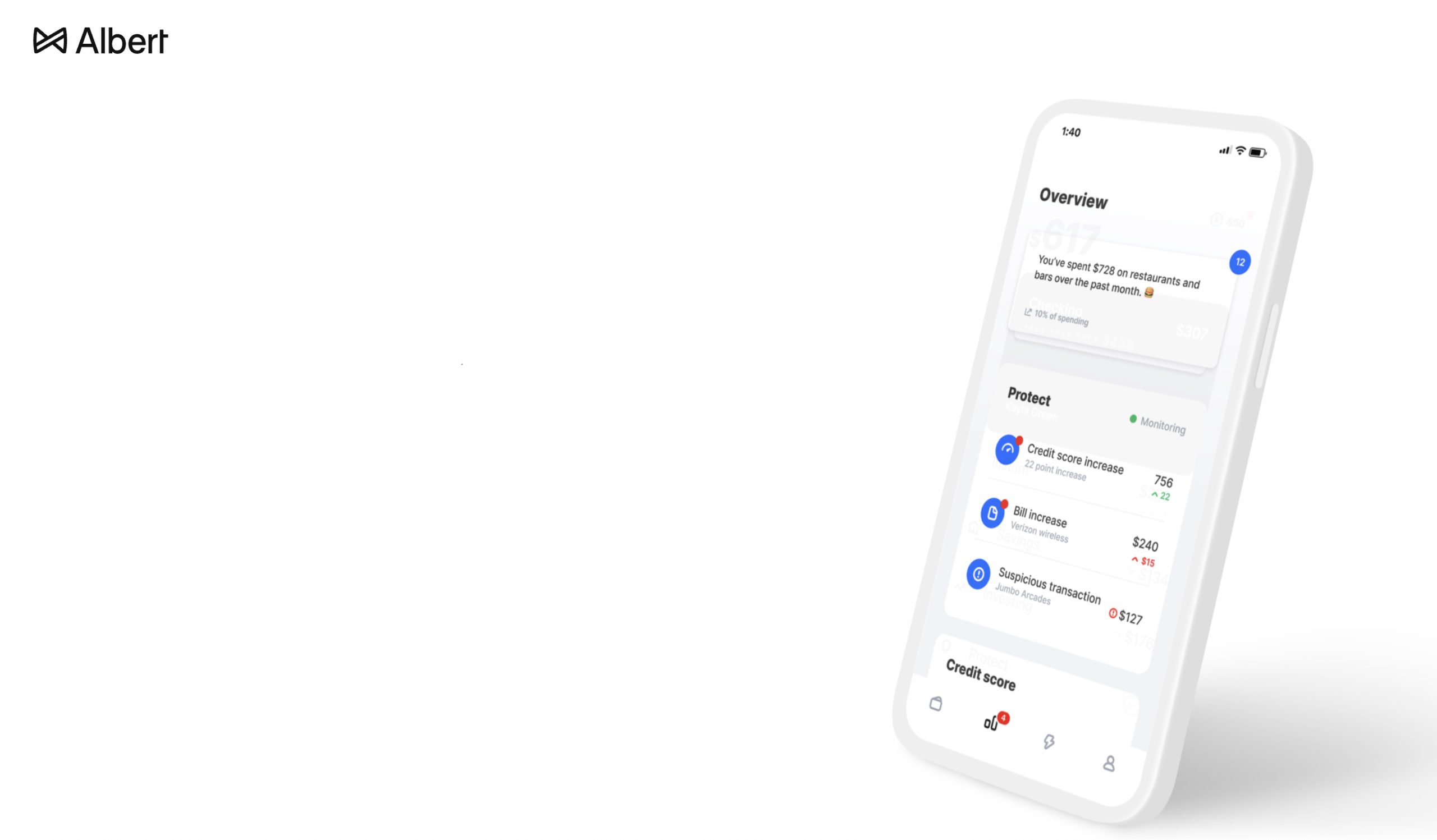

Albert’s overview dashboard categorizes your expenses, helps monitor for fees, and keeps a close eye on subscriptions you forgot you had. It’s like a meticulous bookkeeper for your life, ensuring you know where every penny goes.

In a world brimming with financial apps, Albert stands out by not just tracking but actively assisting you in managing your finances. It’s more than an app; it’s a financial revolution in your pocket. Whether you’re saving for a rainy day, braving the world of investments, or just trying to get ahead of your bills, Albert is the financial buddy you’ve been waiting for.

Here’s a condensed review based on several sources:

Pros:

- The core features of Albert are free to use, including basic banking functions, a view of checking accounts, and the ability to see upcoming bills and saved amounts.

- Albert provides cash advances up to $250, a benefit for users who need quick access to funds.

- Upgrading to the Genius subscription unlocks access to a team of financial experts for personalized advice.

- The app helps users identify potential savings by finding unused subscriptions and offers insurance quotes through its network of insurance companies.

- The funds in your Albert Cash account are held at an FDIC-insured bank, ensuring security and peace of mind.

Cons:

- The app lacks retirement plans, meaning users will need to look elsewhere for IRAs or other retirement investment accounts.

- Some users feel the budgeting tools are more basic compared to those found in apps specifically designed for budgeting.

- The Albert Cash accounts offer a relatively low Annual Percentage Yield (APY) for savings.

- There is a monthly fee for the Genius subscription, which is necessary to access some of the more advanced features.

Additional Features:

- Albert Cash accounts have no monthly fees and provide perks like early paycheck access and cash back rewards for Genius subscribers.

- The app’s Smart Savings tool sets aside money weekly to help users save, with the ability to create specific savings goals.

- Albert’s investment services allow users to invest in individual stocks or portfolios and offer the option for automated investments.

- The financial overview on the app’s homepage offers insights into bills, expenses, savings, and unusual transactions.

Albert’s Genius subscription starts at $8 per month and provides additional benefits such as fee-free ATM access, enhanced budgeting and savings tools, and the aforementioned access to financial experts. The app is generally considered safe to use, with FDIC insurance for banking and SIPC insurance for investments.

In summary, Albert could be suitable for those who want an integrated platform for managing their finances but may not be the best choice for those who need more sophisticated budgeting tools or retirement planning. For more detailed investing, users might prefer specialized investment platforms.